Contents:

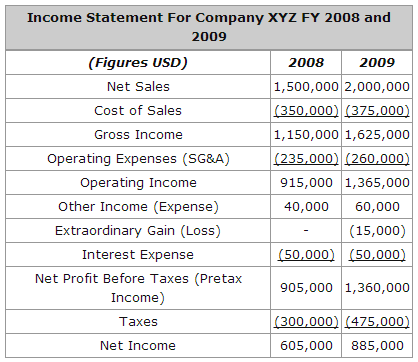

On the income statement, add a small column to the right of the expenses. Product costs are generally variable or semi variable in nature as they are related to the production activity and vary in relation to the level of output. Product costs are incurred to manufacture or acquire goods and thus necessarily form part of the cost of inventory. The potential benefit that is given up when one alternative is selected over another. Important – opportunity costs are not usually found in the accounting records, because they didn’t occur. They have to be explicitly considered in most decisions a manager makes, because virtually every alternative involves an opportunity cost.

The entity’s period cost is just as important as its product cost. The period costs could not be capitalized since they are not directly tied to the manufacture of inventory and are thus charged in the company’s profit and loss statement. Better management of period costs assists the business in identifying expenses and areas of expenses where the same or better services and results might be obtained with less expenditure to the organization.

What items are not included in period cost?

Product costs are also often termed as inventoriable costs and manufacturing costs. Period costs are not included as part of the cost of either purchased or manufactured goods; instead, period costs are expensed on the income statement in the period in which they are incurred. All selling and administrative costs are considered to be period costs. Manufacturing overhead is the catchall category for costs that aren’t materials or direct labor but are still inextricably tied to the manufacturing process. Think of the rent and utilities for your production facility as well as repairs to your factory equipment.

- Product costs are all the costs that are related to producing a good or service.

- The company rents offices for their executives and marketing team.

- Other examples of period costs include marketing expenses, rent , office depreciation, and indirect labor.

- As a result, net income for the period will be reduced due to the higher expenses.

- Since period costs are a broad category, they’re better explained by what they aren’t.

This bifurcation allows teams to efficiently use the data for accounting purposes and for financial modeling which leads the management to decide which cost is important than others. Make a note of how much money you spend on period costs and expense them during the period in which the costs are incurred. Receipts, employee pay stubs, invoices, and other papers that show how much money you pay out for various period costs may be kept. Sales, general, and administrative charges, for example, are an excellent illustration of a period cost because they are charges that are not related to the manufacture of a specific product and are incurred over time.

What is a period expense?

The direct materials, direct labor and manufacturing overhead costs incurred to manufacture these 500 units would be initially recorded as inventory (i.e., an asset). The cost of 300 units would be transferred to cost of goods sold during the year 2022 which would appear on the income statement of 2022. The remaining inventory of 200 units would not be transferred to cost of good sold in 2022 but would be listed as current asset in the company’s year-end balance sheet.

Tracking period costs will also help a business balance its budget and gain savings. It will also allow a business to focus on growing and controlling direct costs. Period cost on the balance sheet would exclude any prepaid expense that does not match the revenue for the current year. On the other hand, period costs are considered indirect costs or overhead costs, and while they play an important role in your business, they are not directly tied to production levels. Like wise, the factory supervisor is needed to produce the product and is therefore a product cost but cannot be identified with a particular unit of production and is therefore an indirect labor product cost.

Period Cost Accounting

budgeting report costs are initially assigned to an inventory account on the balance sheet. When the goods are sold, the costs are released from inventory as expenses . Examples of product costs are direct materials, direct labor, and allocated factory overhead.

Congressional Republicans Call for Reconsideration of … – Ways and Means Republicans

Congressional Republicans Call for Reconsideration of ….

Posted: Wed, 12 Apr 2023 18:11:15 GMT [source]

Other https://1investing.in/ of period costs are selling and administrative expenses. Period cost refers to any expense that cannot be capitalized into prepaid expenses, inventory, or fixed assets. Period costs are more closely related to the passage of time than they are to transactional events. As period cost is always charged to expenses at once, it is better referred to as a period expense. Period costs are charged to expense in the period they are incurred.

Intermediate Accounting

Period costs are essentially charges that could be applied to the company’s income statement for the period in which such expenses were incurred. These expenses are not directly tied to inventory production and so do not constitute part of the cost of goods sold and are charged in the company’s income statement. Because these costs do not relate to the manufacturing of inventory, they can never be capitalized and must always be included in the company’s income statement. Selling costs, overhead costs, advertising costs, and so on are examples of these costs. Period costs are always recognized in profit or loss in the period in which they are incurred. In summary, product costs are recognized in the balance sheet before being expensed in the income statement.

Accurately calculating product costs also assists with more in-depth analysis, such as per-unit cost. Per-unit cost is calculated by dividing your costs by the number of units produced. It is an important metric, particularly when determining product pricing. Rent can be a period cost or a product cost depending on what the rented building is used for.

In other words, they are expensed in the period in which they occur and are recorded on the income statement. Every cost incurred by a business can be classified as either a period cost or a product cost. A product cost is incurred during the manufacture of a product, while a period cost is usually incurred over a period of time, irrespective of any manufacturing activity. A product cost is initially recorded as inventory, which is stated on the balance sheet. Once the inventory is sold or otherwise disposed of, it is charged to the cost of goods sold on the income statement.

After those seven transactions, the ledger included the following accounts with normal balances. Cash$26,660Office supplies660Prepaid insurance3,200Office equipment16,500Accounts payable16,500C. Beltran, Capital17,000C. Beltran, Withdrawals3,740Engineering fees earned24,000Rent expense6,740Required 1. Prepare a trial balance for this business as of the end of May.

For example, the fee for a consulting service offered by external management consultants are PCs, but they are not mentioned in any of the categories above. However, the general formula would be the sum of selling and administrative salaries, bills, and utilities. Costs that are not involved directly in the manufacturing process of inventories. Period costs should be tracked and monitored regularly to ensure that they are in line with a company’s budget or financial plan. Some of its examples are; Marketing expense, selling, general and administrative expense, and CEO salary. The person creating the production cost calculation, therefore, has to decide whether these costs are already accounted for or if they must be a part of the overall calculation of production costs.

The company has clubbed these expenses as “Other Expenses” in the statement of profit & loss account & treated the same as a period cost since the pay is fixed. The evaluation of period costs assists the company’s management in effective planning since period costs play an important role in analyzing a company’s or organization’s financials. Period costs are immediately charged in a company’s profit and loss account and so play a key role in calculating the company’s profit or loss. The costs are not related to the production of inventory and are therefore expensed in the period incurred.

In short, all costs that are not involved in the production of a product are period costs. Operating expenses are expenses related to daily operations, whereas period expenses are those costs that have been paid during the current accounting period but will benefit future periods. Period costs are typically located on the income statement for the accounting period in which they are incurred. Prepaid expenses are reported on the income statement for the accounting period in which they are used or for when they expire.

Eric Sottile has a bacholors degree in accounting from the University of Kentucky and a bachelors degree in finance from the University of Kentucky. Eric works for a public accounting firm and has passed his CPA exams with an average score of 94. The Ascent is a Motley Fool service that rates and reviews essential products for your everyday money matters.